Fund fees have become a contentious topic in the last few years as people have become more aware of them and alternative low-fee options have become more available.

|

|

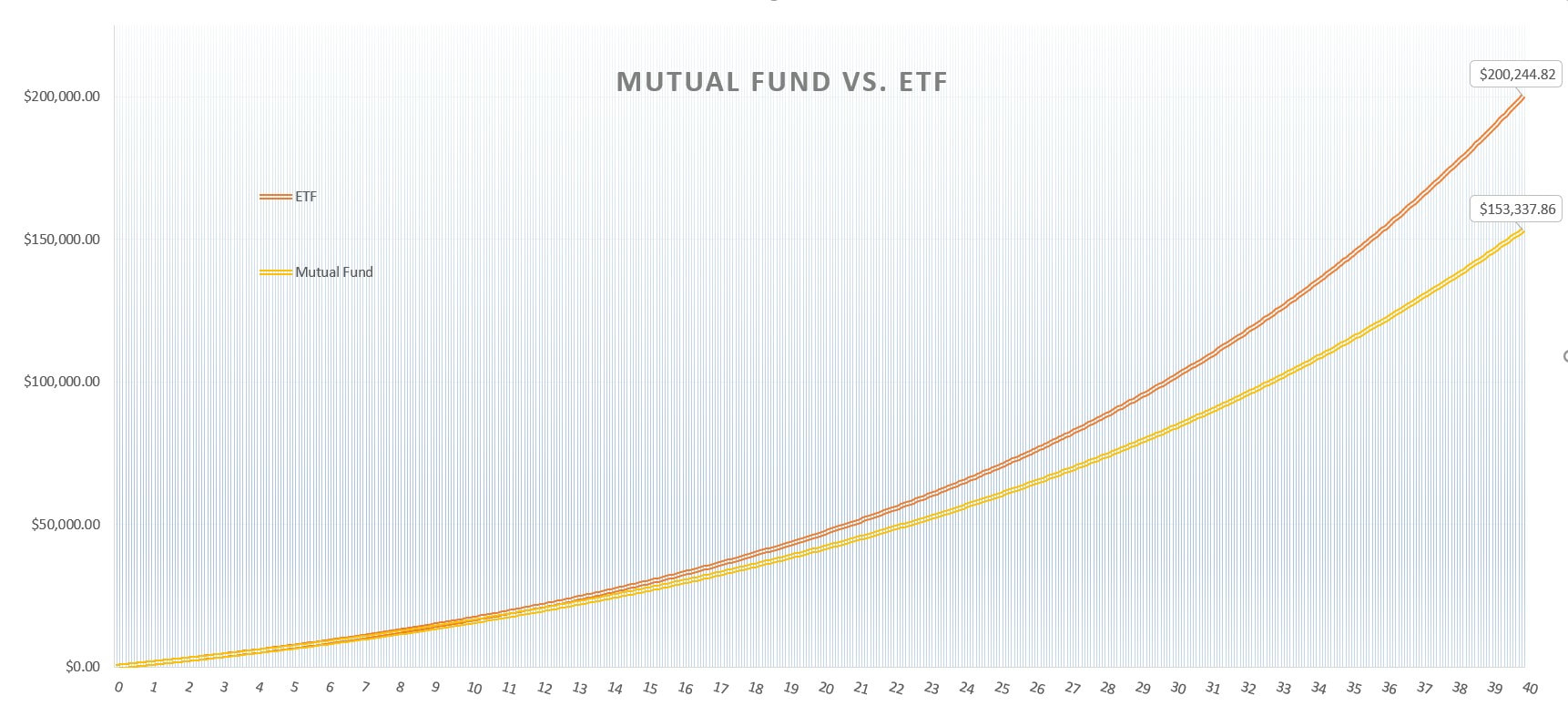

ETF (fee 1.5%)

Mutual Fund (fee 2.5%)

Difference of -

|

$200,244

$153,337

$46,906 (per $100 monthly invested)

|

This is by no means what is actually going to happen, but this is why fees should always be considered. You should ask what the fee is and what the average fee for a fund in the sector is.